There are various regarding real estate loan items that you could potentially choose from, so you should do your homework to find the the one that gets the cheapest price. In terms of Wells Fargo home loan cost, so as to he’s only he’s got been in many years. Consumers are just starting to consider Wells Fargo because of their mortgage mortgage applications and you may refinance mortgage situations. Whether you’re thinking of buying an alternate house, loans your existing no. 1 or refinanced home loan, or to generate another house, you can make use of an excellent Wells Fargo financing for your needs. Continue reading to determine how you can have the best contract to the an interest rate off banks such as Wells Fargo.

Then you will be in a position to choose a mortgage that try either fixed-speed or varying-price

While necessary to go on to an alternate state otherwise city because of employment, you are able to The fresh new Relocation Financial Program within Wells Fargo to aid you. This choice will provide masters and certainly will assist you to pick the right Wells Fargo financial prices to suit your problem. You are going to speak you to definitely-on-one to which have a moving home loan consultant, that will discuss their money alternatives. A few of the financing affairs you could select from are the brand new design, plunge, res. You will be merely permitted to utilize this program to own no. 1 houses, so if you simply be in the latest household getting a few weeks otherwise days regarding a great twelve-day period, upcoming this one is not most effective for you. You also have are thinking of moving another type of city otherwise county was at minimum thirty five far away, by request from your own company.

The majority of people found modular land to be favorable since they are developed to seem particularly a vintage domestic, but really they are much, less expensive. The caliber of modular home features accepted a lot over the age, making them just as safe and reputable because the a webpage-centered house. Modular property is constructed for the a manufacturing plant and transported to your house. Because they are built in a plant, the materials commonly confronted with rain or any other outside aspects one can harm the quality of your home. Enough time it takes to construct a modular residence is an excellent package fast too, since there are zero climate delays to consider. You could obtain resource getting yet another standard home of the looking for from Wells Fargo financial pricing that will loans Flagler be offered. See if you can select a package and that’s affordable to suit your house income.

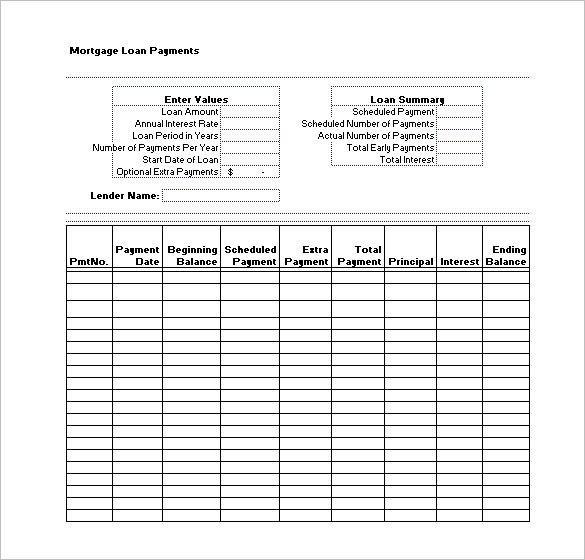

You must know what charges you will have to shell out initial therefore the costs that accumulate across the lifetime of your loan

Whenever obtaining a mortgage off Wells Fargo, there is the substitute for possibly float the interest rate otherwise lock they in. Exactly as it sounds, a speeds lock-inside occurs when you include the rate, keeping it out-of changing right up or down. Their will ensure the rate unless you close the borrowed funds financing. Securing on your rates will allow you to maintain the speed to possess a particular timeframe (always between 15 and you may two months, but can be up to annually for brand new house buildings). Drifting home financing price enable the rate to help you vary, providing you with the chance to discover a reduced later than your have now, however, that isn’t protected. Understand that could result in which have increased rates, very choose wisely.

One good way to get your interest levels upon a good Wells Fargo financing is always to shell out write off factors. For every area is short for 1 percent of your own amount borrowed. If you pick dismiss affairs, you could potentially deduct they from your own tax. You are not needed to pay for discount items, however if may be a good idea to manage if you are planning to are now living in your house for over 5 years. But not, if you’re going to be selling our home in a number of many years, then you can favor never to get dismiss items. So you’re able to determine what you need to do, you should use a loan calculator to simply help determine the newest monthly payments and you may savings might see.