Cash-Aside Refinance: A money-out refinance pertains to refinancing your mortgage to possess increased count than simply what you already owe and you can taking out fully the difference in the bucks.

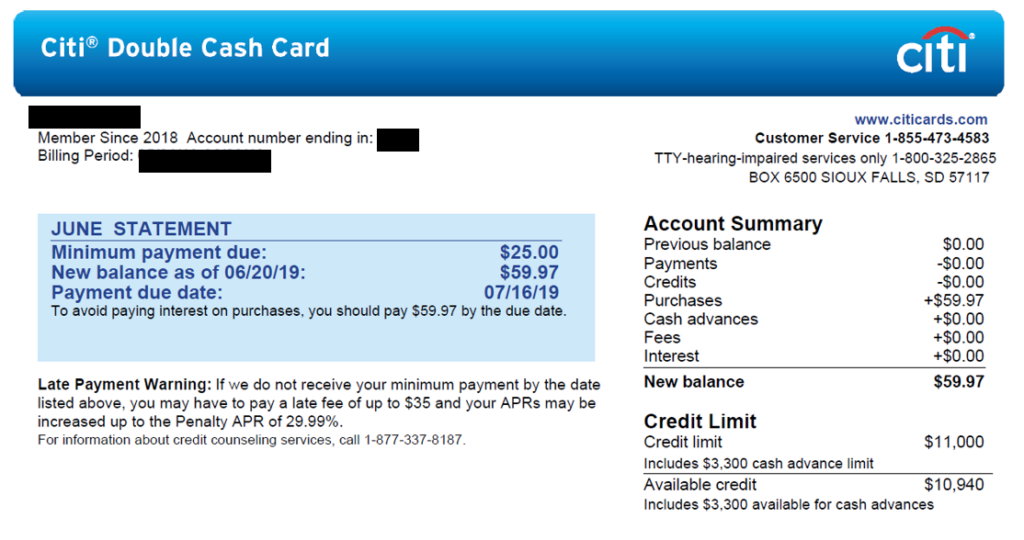

Playing cards: Property owners may play with playing cards to finance do it yourself projects. But not, credit cards typically have large rates than many other particular loans, so it is important to look at this alternative carefully.

It is essential to carefully consider each type installment loans, Albuquerque off home improvement mortgage and choose one which is the best for your own personal monetary disease. Speak with a monetary mentor or lender in order to make an educated decision.

How can you Select the right Do it yourself Financing?

How do you like a great home improvement mortgage? Influence the expense of renovations, exactly what money option is appropriate, and you may evaluate loan options in order to find the least expensive price you can easily. I do want to borrow cash off my very own domestic. Any kind of other option solutions? Must i get government financing? Why don’t we start our loan application techniques.

Credit cards Good for affordable, small-measure ideas

Take advantage if you’d like to invest a small currency on the a unique automobile or paint opportunity that you like to finance for a couple days. Of many credit cards have to give you twelve-times free 0% Apr episodes which means that you might not spend interest on the balance more than one year. You’ve got the accessibility to generating revenue back when you will be making an improve pick. It should be kept less than 20% to reduce costs. An increase to own credit cards is among the higher (as of June 31), however, an excellent costs can get in the future snowball or decrease your credit history.

What’s the best mortgage having renovations?

An informed financing having home improvements is determined by your personal finances, together with specific specifics of your residence improve endeavor. Here are a few a few when selecting an informed financing for your house improve opportunity:

Interest levels: Pick that loan that have a low interest, since this will assist keep the overall cost off credit down. House guarantee funds and you can HELOCs routinely have all the way down interest rates than signature loans and you will handmade cards.

Financing Conditions: Think about the repayment identity of financing. An extended repayment name may result in straight down monthly obligations, but may end costing your a great deal more within the appeal along the lifetime of the mortgage.

Amount borrowed: Ensure that the loan amount you are approved getting is sufficient to safeguards the expense of your house improvement investment.

Guarantee Criteria: Particular financing, such as for example house security money and you may HELOCs, was covered by your family. If you aren’t safe placing your house right up due to the fact collateral, imagine an unsecured personal bank loan.

According to these activities, a home security loan otherwise HELOC is the greatest loan for the majority of people. This type of fund generally render low interest rates and longer payment terminology, causing them to an appealing selection for investment big do it yourself programs. not, it’s important to very carefully envision most of the mortgage choices and consult an economic advisor otherwise bank in order to make greatest choice to suit your private state.

Common Do it yourself Mortgage Spends and you may Will set you back

Renovations try since cheap and also as expensive as you to definitely that you desire you need to include anything from replacing shelves to incorporating an extension. Just be in a position to imagine the overall project prices earlier if you’re considering an investment. Considering your budget, you could prevent running out of currency. According to the Will cost you Against Philosophy report from the Building work Journal, the cost in the place of Top quality declaration means what property owners invest in a property: