Why would a loan provider also bother broadcasting range letters with the a loan that is becoming repaid in sophistication period?

I experienced a comparable problems for a couple of years,very first that have Financial away from The usa & it marketed my loan so you’re able to Nationstar and Heck for another season . I did so that which you they inquire & it nevertheless grabbed my personal area household. I have all the records labels & some one I talked to for these 2 yrs. Do i need to make a move to track down a global funds. That it seems to my a crisis having more and more people who did exactly what Nationstar query & it nevertheless took all of our belongings. We must get actually in some way. My urban area domestic was at New york

You’ll want to get with a lawyer from inside the NC. Was Maximum Gardner – he may might help otherwise section one someone who can be.

There is certainly up coming law out-of restriction issues therefore i manage flow quite timely to find out if you have still got people options.

John: My situation which have Nationstar is somewhat unique of the previous prints, however it is just as irritating for me. I’m curious if you’ve ever came across this case.

Nationstar overran the servicing this past ortized fixed rate mortgage which was came from 2004 and you may offered to CitiMortgage in the 2005. Which loan now has an equilibrium regarding under $11,800 and you will be reduced because of the . Really don’t escrow to possess taxes and insurance with this possessions in addition to mortgage repayment is actually less than $450 1 month.

The report regarding FDCPA and you can Nationstar hit a chord beside me because of your statement Just about all, if not completely, of your own fund Nationstar becomes away from Financial of The united states (or any other servicers) are located in standard and thus Nationstar was a loans enthusiast.

Can there be any possibility you to my personal financing was offered to Nationstar by CitiMortgage while the I tried to acquire them to give it up and desist?

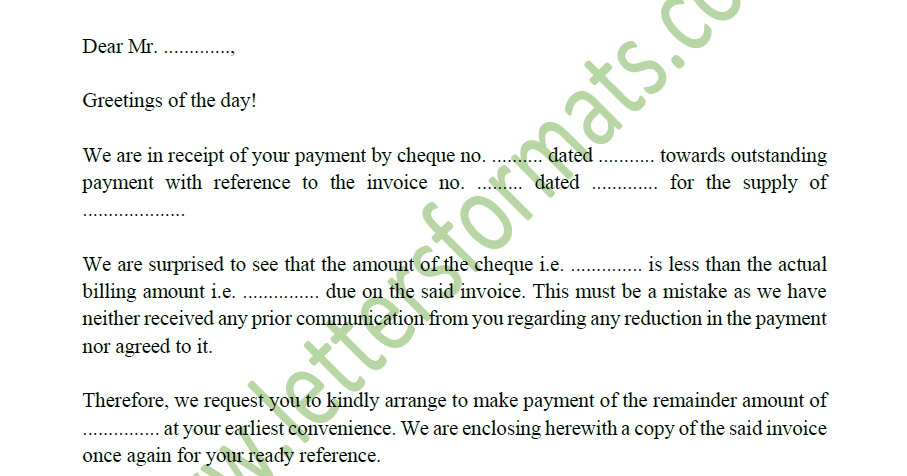

My personal loan, yet not, is not inside standard into a dozen.five years it has been in existence, yet , my personal month-to-month mortgage report implies that this can be a you will need to gather an obligations, and that message is also towards the customer support line tracks for Nationstar. Every month that loan try directed out of Citibank I get a different sort of letter away from Nationstar and additionally a credit counseling letter. I’ve delivered two cease-and-desist characters to help you Nationstar to make sure they are stop so it practice, yet , it continues on.

You ought to know that earlier servicer, CitiMortgage, become broadcasting yet another letter and you will CCCS connection beginning in in the event that percentage wasn’t gotten by the 10th of month, but this had never ever took place for the earliest five years that that they had the mortgage. I attempted repeatedly to find Citimortgage to cease that it routine, and you will escalated it to your CEO’s place of work and you will got no place, even after multiple cease-and-desist emails. It fundamentally said within the 2012 that they had to transmit away a profile page in the sophistication several months so you’re able to follow for the investor’s requirements but I am able to never influence who the brand new individual are. Whenever Nationstar presumed new maintenance of your loan last summer, nevertheless they continue steadily to post range letters, but speaking of dated also before…towards 3rd of the times.

I actually do has actually a great 15 date grace period that’s specified on the mortgage mention therefore i don’t understand why that it behavior Mead loans can be acquired. We delivered to Nationstar a cease-and-desist page but I still continue to get such range emails.

Would not it end up being a pass of your FDCPA? How to influence which the new trader would be the fact possess it loan to make certain that I will contact all of them?