Often Getting Pre-Recognized Hurt Their Borrowing?

If you find yourself considering to buy a home, you probably know that their borrowing performs a crucial role for the taking approved to possess a home loan. The better your credit score, the greater your own terms and conditions are, so making certain there is the finest score you can easily is essential.

not, you have probably also heard you to definitely taking pre-accepted can hurt your credit score. you be aware that you should get pre-recognized (unless you are paying bucks) for the reason that it will say to you exactly what domiciles you might shop for.

Skills Your credit score

Your credit rating comprises of five different facets, and you may wisdom them will assist you to know what to complete 2nd.

- Percentage Record 35%

- Amounts Owed 29%

- Amount of Credit rating 15%

- Borrowing from the bank Combine 10%

- The fresh Borrowing ten%

These types of four circumstances was the way the credit bureaus dictate your FICO ratings, and as you can find how much you use and exactly how you pay off your debts certainly are the one or two foremost categories.

The class that all works together home loan pre-approvals are your Borrowing Mix. Borrowing Mix are 10% out of how your credit rating is factored. Whenever a lender or lender brings the credit this really is recognized just like the a cards inquiry. With way too many credit concerns for the a short period of your energy normally negatively apply to your credit score.

personal loans Oasis NM no credit check

Hard Inquiries

Tough borrowing questions try issues that will show up on their credit file, and these typically can be found after you submit an application for financing otherwise credit card.

- Finding a car or truck and you may Applying for Financing

- Obtaining a new Charge card

- Requesting Personal line of credit Develops on the Bank card

- Financial Pre-Recognition

Delicate Issues

Mellow issues is actually inquiries created in your borrowing from the bank, however they do not appear on your credit history, hence dont apply at your score.

Often Borrowing Issues Affect Your credit rating?

The latest effect out-of trying to get credit vary from person to person considering her borrowing records. Generally, borrowing from the bank concerns have a tiny effect on their Fico scores. For most people, one to more borrowing query needs lower than four facts off its Fico scores.

Whilst you will see its yes possible that borrowing issues can be lower your rating, the effect he’s are really small as opposed to other factors. Also, the principles getting rate searching vary than those to have implementing for brand new personal lines of credit.

Finding brand new credit can be associate with higher risk, but the majority Fico scores commonly influenced by numerous inquiries regarding auto, financial, otherwise education loan loan providers within a short period of time. Generally, talking about addressed as just one inquiry and will have little impact on your own credit ratings.

The length of time Commonly Issues Remain on Your credit score?

Tough issues can look on the credit history for two age about big date your borrowing was pulled. But not, the credit bureaus will factor all of them to your credit score to have 1 year regarding big date your credit score try removed.

How come a home loan Pre-Recognition Apply to Your credit rating?

How do a mortgage pre-acceptance apply at your credit score, the clear answer is quite absolutely nothing. Taking pre-approved don’t harm your credit score. You could select at the most a good 5 facts lose on earliest financial which pulls the borrowing, but zero obvious effect immediately after.

A different sort of together with is that after you work on a large financial company, instance Bayou Home loan, we could remove your own borrowing once and you can shop countless lenders for your requirements in about 5 minutes.

And, mellow borrowing from the bank brings get well-known about mortgage globe, especially as a way of going a great pre-approval. If you use one of many larger on line loan providers, they are just gonna perform a softer borrowing eliminate unless you wade less than price, but this is certainly challenging because the we will speak about less than.

What is actually a home loan Pre-Approval?

A mortgage Pre-Approval is a procedure that homeowners go through when they are happy to initiate looking for a property. In order to get a good pre-approval, you really need to done a home loan application and provide support paperwork.

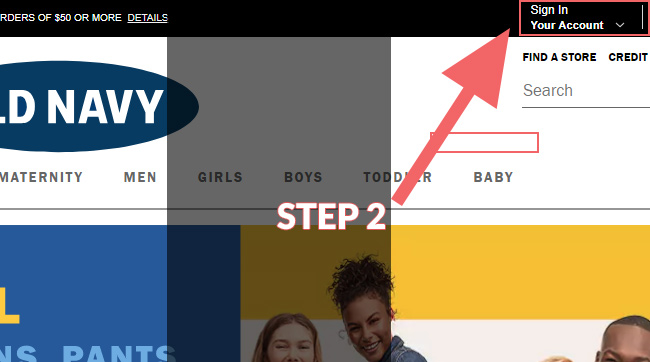

Measures of your Pre-Approval Procedure:

Taking a complete mortgage app using required records try the only way to have a genuine pre-acceptance. Although on the internet lenders are performing delicate borrowing from the bank checks and you can doing brief financial apps, speaking of maybe not real pre-approvals.

If you haven’t given registered an excellent tri-blended credit history, render files you to assistance your earnings and you can property you are inquiring for a disaster.

Why should you Score Pre-Acknowledged

Getting pre-approved is important since you can’t confidently discover belongings as opposed to that. If you don’t have good pre-recognition page, of numerous real estate agents wouldn’t make suggestions house. Regardless of if they do guide you house, you have got no real suggestion if you will be acknowledged to help you buy the household.

Good pre-approval eliminates the doubt and you can nervousness that accompany to purchase an excellent household. Once you work at an established financing administrator, a beneficial pre-approval makes it possible to shop with similar believe since the a funds client.

Getting pre-recognized will provide you with peace of mind, and also make your residence to find sense a great deal easier. Coping with a lender and you may starting the tough works upfront have a tendency to ensure that you know what to expect upfront, and will lose high priced mistakes afterwards.