Fundamentally, next home mortgage prices is actually high. The borrowed funds financial was providing a much bigger chance that have a second real estate loan.

For those who be eligible for another home loan, the lender sets a separate lien on the household. Another lien holder will get repaid next in the eventuality of a foreclosures. Very, the latest rates having next mortgage loans mirror one higher risk.

When Was an extra Home loan best?

Taking out fully one minute home loan can be most effective for you if the you may have a huge expenses but currently have the lowest price on your own first-mortgage. Very mortgage benefits merely suggest refinancing a primary mortgage for individuals who can save at the least .5% on your price.

Providing a house equity financing or HELOC also can end up being an effective great circulate if you would like currency to possess something enjoys an excellent strong return. Instances is a home update, a college education, or to invest in a residential property.

The mortgage notice into the second mortgage was tax-deductible When you use they making a primary improvement to your residence. Instances was a home or shower renovate, incorporating a share, or living room area addition. Can it be far better re-finance or take aside a property equity financing?

If you get a property Security Financing or a type of Credit?

What is actually your risk threshold? A home guarantee financing have a fixed rate of interest and put repayments to the longevity of the borrowed funds. Those who particularly so much more financial certainty may like a home equity financing.

As well, a home collateral credit line has a lower life expectancy interest at first. Nevertheless speed can go up much more in the future. Whenever you bed at night with this particular suspicion, an effective HELOC financing can perhaps work to you.

Contemplate if you’d like a massive amount of cash right today, or money sporadically over time. Property equity mortgage will provide you with your entire readily available security immediately, therefore pay attract into it all out of day you to.

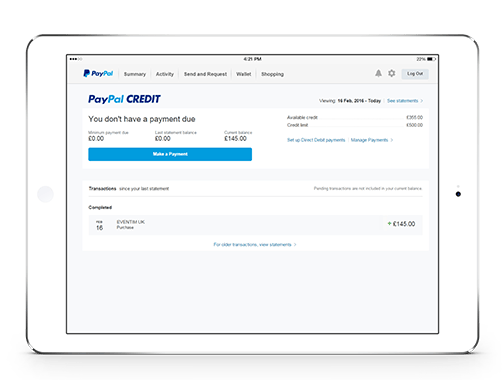

A HELOC brings fund for your requirements as you need all of them, and you also pay just focus about what you use. Evaluate the current HELOC prices.

As to why 2nd Mortgage loans and HELOCs Usually Roar Back Reappearance when you look at the 2024

Mortgage cost take the rise by , lately flirting that have 6.5% having a 30-year home loan. In reality, the fresh new repaired rates device strike 5.02% just before losing towards 4’s once again. It was the best home loan prices was just like the 2003, and you will ahead of one to, rates had not strike 5% as 2011. The better cost possess contributed to home loan regularity dropping 41% of last year since a lot fewer folks http://www.availableloan.net/installment-loans-ne/eagle/ are buying land and you will carrying out refinances.

In addition to, just remember that , rates have the 3% variety for several years, thus scores of homeowners have contract-basement mortgages. Higher financial cost are a stress getting home buyers since they can not pay for as often domestic because annually otherwise a couple of in the past. High prices for mortgages may getting burdensome for property owners exactly who wished to would a money-out refinance.

Cash-out refinance mortgage loans is popular with homeowners who want to get a lesser mortgage speed and remove-out bucks getting home improvements and other purposes.

The good thing to have residents who happen to be flush which have collateral once enjoying ascending home values for several years: You still could possibly get an extra mortgage otherwise home collateral personal line of credit (HELOC) to get the bucks you need and keep maintaining your first mortgage positioned.

If you’d like to remove the bucks need, it could be for you personally to imagine an effective HELOC that have the lowest price! Which next financial is a wonderful chance to see dollars to own house home improvements plus at a cost a great deal more sensible than just personal loans and you will handmade cards. A whole lot more banking institutions and you may lenders are beginning to help you approve the second mortgage that have poor credit.